NS-SPS 104 – Make That Money

Course Description

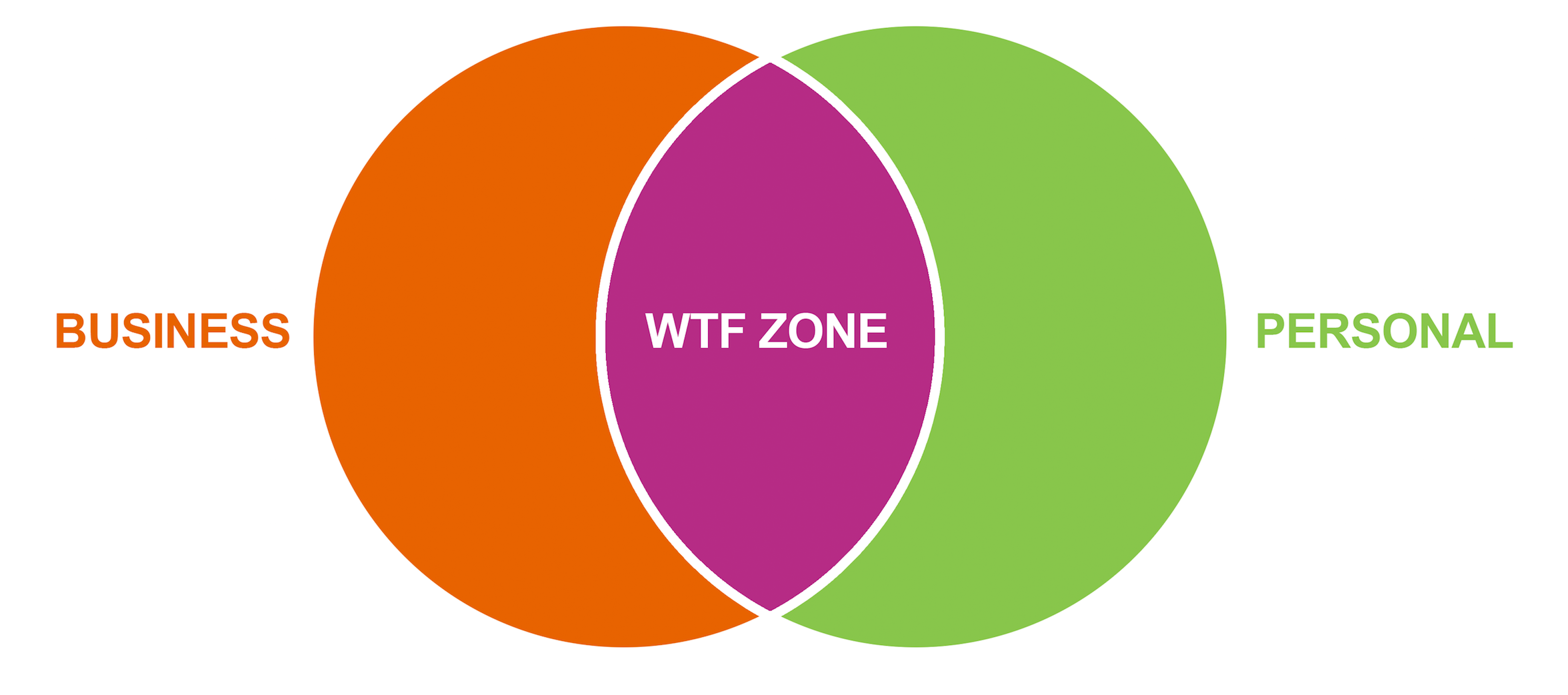

The most epic money-planning course ever. This course will answer those gnawing questions in the back of your mind about what the EFF you need to do to afford all the things. As a sole-proprietor, your business finances ARE your personal finances. Whether you’re saving for a trip, buying a home or maybe you just wanna work less so you are not a slave to your computer, your business needs to Make That Money so you can have a life , go on vacation and pay your bills. Let us lay it alllll out for you.

When you take this course you will know:

- What you need to make every single year/month/day so you can have a life and pay your bills

- What you need to charge for each of your services/goods

- How much you need to work (how much you need to sell) for every revenue stream that you have

- What your business can afford (can you rent an office? Hire help? Get new equipment?)

- How much your business is capable of earning if you hit all your sales targets

- If you’re a side hustler and want to quit your 9-5 but don’t know how much you need to make or what you need to do to quit – this course will show you how much you need to earn from your business to support your personal life so you can quit with confidence.

What you get:

- A Personal Financial Audit (designed by a financial and tax professional – Shannon)

- We go over your personal finances in a big way. It’s like sitting down with a financial planner. We figure out what’s coming in (from business or outside of business) and what’s going out.

- This is where you dare to dream… put in that vacation, pop in that mortgage payment on the new home.

- Let’s see how much it costs for YOU. SPECIFICALLY to be happy. This may be $25,000 for some and $250,000 for others! This part is fun and not sh*tty… trust, trust.

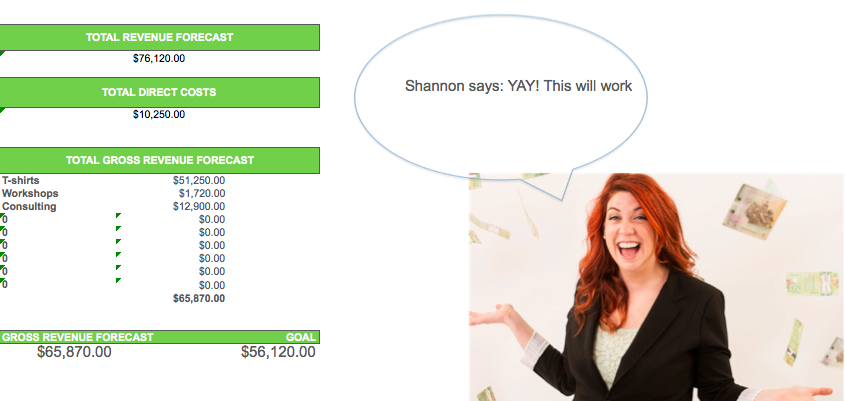

- A Proper Business Forecast (designed by financial and tax professional – Shannon)

- We realistically forecast your sales, overhead & direct costs

- This is where you get the opportunity to put in things you want to test.

- Oh, can I take on rent?

- Can I take on new employees?

- Can I afford to pay for this new training? Conference? etc

- In addition, we take your taxes into account – I’m obsessed with being legit..taxes are gonna happen, so ya know, let’s plan for it.

- The Ultimate Business Planning Tool

- You get an EPIC spreadsheet tool that you can customize on your own (this is the shit because it’s not a static PDF worksheet where you waste paper and fill out by hand)

- This tool legit maps out what your biz needs to earn so both you and your business break even. Hells yes.

- You can change the inputs in the spreadsheet like “hmmm… what if I hired a person for 2 days a week. Nope, that’s not gonna work. Ok, what if I hired someone for 1 day a week. Oh, sweet. yes.”

- Or, hmmmm.. what if I wanted to go on a big vacation each year and put aside $3000 for that… can I afford that if I work less?”

- GET THE ANSWERS and use the tool for some sweet, sweet biz planning.

- You keep the tool for life and EACH December/Quarter/Month, you should use it to plot out your sales targets, price targets and overhead targets so you can earn money like the boss that you are.

- You can customize all your business LEVERS: prices you’re charging, purchasing costs, overhead. And, your personal life: increase your salary, decrease your monthly bills, increased savings.

- No other course out there takes this much of a REALISTIC approach to the marriage between your personal financial life and your business financial life. THEY ARE SO INTERTWINED.

- Whether you’re starting out and need to know what you need to do to quit your job, or your a seasoned vet and wanna know how to revenue plan the sh*t out of your business so you can: buy a home, have kids, pack it all in and move to Costa Rica – WE GOT YOU.

- This course is EPIC. I can’t even deal with it. That is all.

Course FAQ

How Long Is The Course?

How will this save me money?

- You won’t waste your time selling your stuff at the wrong price points and for the wrong costs. This course will outline what you need charge in order to make it work instead of learning the hard way.

- You won’t waste money on things that aren’t profitable – i.e. if you think you can afford to take on an employee, let’s map out how much you can pay them and how many hours max they can work BEFORE you hire them just in case you actually can’t afford it yet.

- Having a plan that you can implement easily with a TO DO list will help feel like you’re on top of your shit. Priceless.

- If you’re about to quit your job, you will know how many clients/customers MINIMUM you need to have before taking the plunge and how much you should have in savings before you do to cover your personal bills etc.

- This course will save you money because it will stop you from overspending, undercharging and being unrealistic. It will save you time, money and energy.

Should I be scared? What if my business is not profitable?

- You shouldn’t be scared. You should be excited. Entrepreneurship is all about seeing a problem, solving it and finding ways to make things work. Let’s find out how much you need to life the life you wanna live.

- If your business shows that you aren’t profitable right now, this is effin’g awesome. Now you know!!! You ripped off the band-aid and had a HARD look at your business. Time to get planning. This tool will help you see what you need to do to MAKE it profitable and viable. So, it’s the best because there’s ALWAYS hope.

Pre-Requisites:

- Ability to open excel spreadsheet, PDF documents, online video streaming (aka the Internet)

This course is ideal for:

-

Sole-proprietors (or those who are just starting out) who sell goods, services and digital products

-

Service-based sole-proprietors: coaches, freelancers, info-preneurs, fitness-preneurs and goods-based businesses: crafters, artisans, retail & online shops, artists etc.

- This course can be used by Solopreneurs around the world! Just make sure that you use your own country’s tax rates when estimating (this only happens once) as the ones we give examples of are CDN specific.

Course Restrictions:

- This course specifically excludes the following industries: long-haul truck drivers, mining, telecommunications, oil & gas, industrial manufacturing

$147

(or get all 4 sole proprietor courses for $397!)

“The courses are amazing. Sole-Prop School paid for itself with tax deductions in one year alone. Make That Money is also freakin’ crazy for planning out your yearly revenue!! I’ve never been so excited about spreadsheets in my life.”

“I’m so happy I did it. I just did my 30 mins of bookkeeping for the month before answering this email and it feels damn good to be on top of my shit now. I get what I’m supposed to do! I feel lucky that you had this program out when you did, just in time for my first tax season as a sole prop. I’m a lucky lady. You’re great!”

“It was mind blowing. I found all of them [the modules] fun. They’re fun because your energy is fun. I LOVE that you can make the most difficult and “boring” topics really entertaining and fun to watch. The way that you present taxes made me actually WANT to tackle that part of my business instead of leaving it to the last minute. You’re super motivating.”

“Taking my business to the next level was stunted by my lack of confidence and knowledge about my business financials. Make That Money gave me such much clarity. It made me take my business more seriously, because I clearly understood what I needed to do to transform it from a weekend craft hobby into an empire that supports me full time. I’m living the dream, and never have to count a receipt [Track That Shiz] again thanks to Sole-Prop School!”

Meet Your Teacher

Shannon Lee Simmons

Shannon is a Certified Financial Planner (CFP), Chartered Investment Manager (CIM), media personality, personal finance expert and founder of the New School of FinanceTM. She loves helping everyday people survive the new economic climate through personal finance, ethical investing and small business advice. Simmons is widely recognized as a trailblazer in the Canadian financial planning industry and an expert in Millennial personal finances and the digital world and it’s relationship to our money. She was named one of Canada’s Top 30 Under 30 and she recently won the 2014 Notable Award for Best In Finance. She is a regular financial expert on CTV News and also appears as a financial expert in the media, a regular contributor for Toronto Star’s Money Makeover and BBC Capital and host of Coral TV’s Money Awesomeness. Shannon travels across the country speaking for some of Canada’s largest corporations and universities including IBM Canada, The Canadian Women’s Foundation, University of Toronto, Ryerson University and Bishops University to name a few.

NOT SO FINE PRINT

- Please ensure you have read the Pre-Requisites and Course Restrictions for this course before signing up.

- This course is not financial or tax advice. The information in this course is for educational purposes only.

- The information in this course does NOT replace the information in the Income tax act or it’s Regulations.

- For all Quebec residents, the information given in this course is federally oriented and may not take specific tax differences for Quebec into account as Quebec residents may be subject to specific rules that are outside the scope of this course. We invite you to get in touch with us at info@newschooloffinance.com for more information before you purchase to confirm whether this course will suit your needs.

- Les renseignements fournis dans le cadre de ce cours concernent surtout le palier fédéral et peuvent ne pas tenir compte des différentes règles fiscales auxquelles sont soumis les résidents du Québec. Nous vous encourageons à communiquer avec nous à l’adresse info@newschooloffinance.com pour obtenir de plus amples renseignements avant votre inscription, afin de vérifier si ce cours vous convient.

- All courses will be charged in USD (based on that day’s USD equivalent to the CAD course price). Your credit card may charge you a different exchange rate or additional fees for foreign transactions.