Their credit score number we mean. Get your mind out of the gutter!

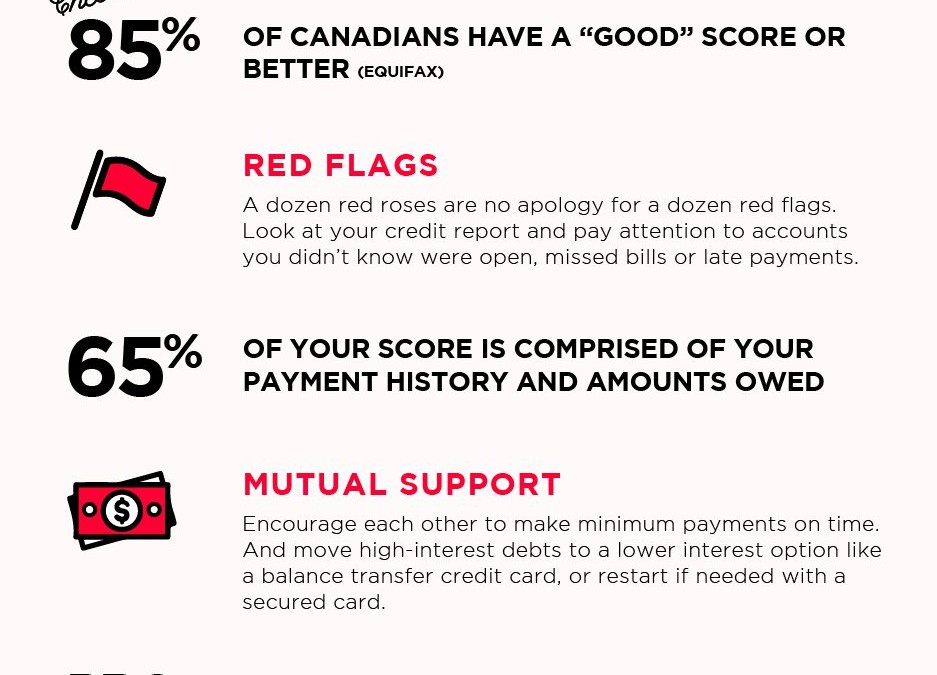

Less than 50% of Canadians know their credit score, according to RateHub.ca, which is kind of amazing considering how important it is. Without a good credit score it is hard to get a loan at a good interest rate for a car or mortgage, and oftentimes even landlords check it out before renting to tenants. And if you and your partner want to build a life together, chances are you’re going to have to drive or live together!

Sometimes employers even run a credit score check before offering you a position! How depressing would it be if your honey had to turn down a position because of a forgotten, but unpaid gym membership?

According to RateHub’s recent Digital Money Trends Report, 73% of Canadians believe their credit score is “very good” or “excellent”, yet only 42% of Canadians say they know their credit score.

Luckily, you can FINALLY check your credit score for free, either at ratehub.ca or borrowell.ca (it won’t affect your score to check). No more calling Equifax or Transunion and talking to a robot for 20 minutes to figure it out. #thankyoutechnology.

Knowing your (and your partner’s) score can help you identify any financial issues you may have as a team, like bad credit card habits or overwhelming student loans. Since finances are the #1 cause for divorce, you NEED to have an open and honest conversation about them!

But HOW, you ask?

That’s where our Budget with your Boo course comes in.

We teach you how to grab a bottle of wine, turn off Netfix and join us in the Tree Of Trust. It only takes 90 minutes to revolutionize the way that you and your boo make plans, talk about money and run the daily finances. The course is redonkulously fun and so important for your future plans!

Recent Comments